White House aides are quietly making a proposal within the Housing Republican Party that would raise the tax rate for those earning more than $1 million to 40%, two sources familiar with the discussion told Fox News Digital to offset the cost of eliminating tips on overtime pay, tilting wages and retirement Social Security.

Sources stressed that the discussion is only preliminary and that the plan is one of the plans many have talked about as Congressional Republicans work to advance the president. Donald Trump’s Adopt the budget reconciliation process agenda.

Trump and his White House have not yet stood on the matter, but his aides and staff on Capitol Hill are considering the idea.

Meanwhile, including Speaker Mike Johnson (R-La.

Trump is willing to send violent U.S. criminals to El Salvador prison

Speaker Mike Johnson is working to pass President Trump’s agenda through budget settlement procedures (Getty Image)

“I’m not a big fan of doing this. I mean, we’re Republicans and we cut taxes for everyone,” Johnson said on Sunday morning futures.

A Republican lawmaker asked about the proposal and approved frankly that they would be willing to support it, but prefer a higher starting point than $1 million.

The reaction was “mixed” among other House Republicans, they said. However, not all House Republican members are inconsistent with the discussion and it is unclear how dispersed the proposal is.

However, it shows that Republicans have profound differences on how to formulate Trump’s tax agenda.

Meet Trump’s chosen congressman Johnson

Expanding Trump’s 2017 Tax Cuts and Jobs Act (TCJA) and developing his new tax proposal is the cornerstone of the Republican program plan for budget settlement procedures.

By lowering the threshold for the passage of the Senate from 60 to 51, it allows those in power to oppose the opposition to pass a thorough legislation to advance their own priorities, provided measures involving taxes, expenditures or national debt.

The tax cuts that extend Trump are expected to lose only trillions of dollars. But even if Republicans use budget calculations to hide their costs (called current policy benchmarks), they still have to find a new policy avenue to eliminate taxes on tips, overtime pay and social security checks for retirees.

A hiking tax on super-rich and healthy can also put Democrats in a tricky political situation, forcing them to choose between supporting Trump’s policies and opposing the ideas they have pushed for years.

House Majority Leader Steve Scalise also objected to raising taxes on the rich (Reuters/Mike Segar)

Currently, the highest income tax rate is about 37%, with a single income of $609,351 and a married couple earning $731,201.

But raising interest rates for millionaires could be a way to pay for Trump’s new tax policy.

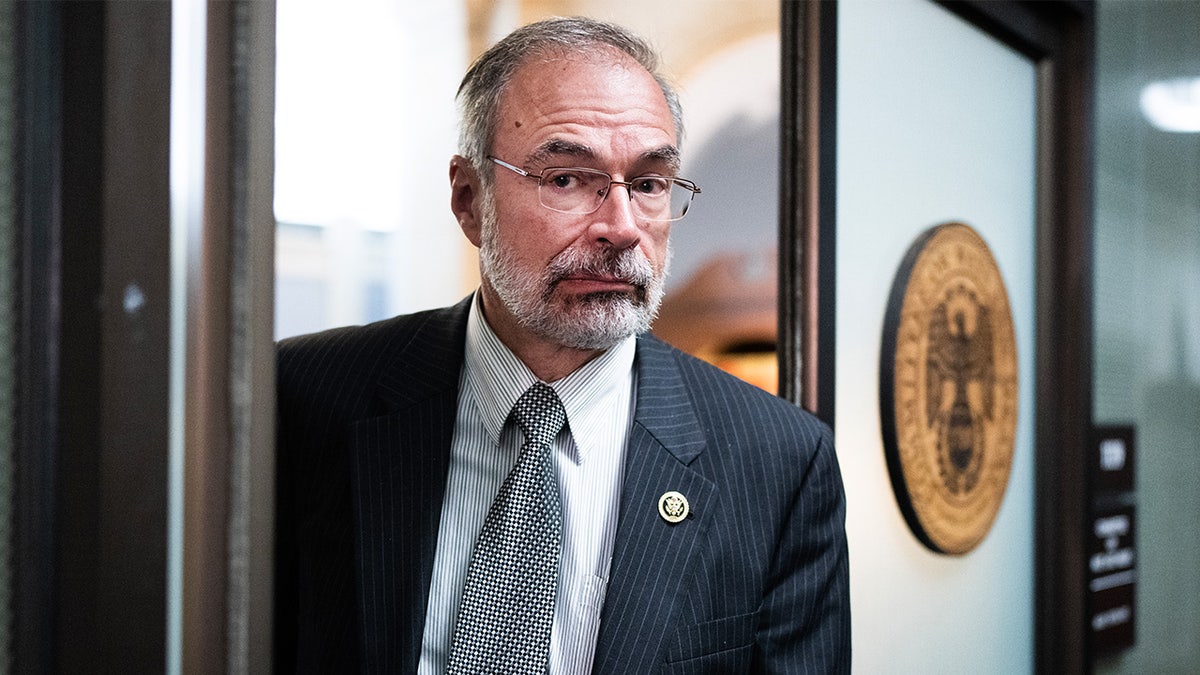

Chair of the House of Representatives Freedom Caucus Andy HarrisR-Md. It was one of the Deficit Eagles, who led the charges to ensure new spending is paired with deep cuts elsewhere, he said: “It’s a possibility.”

Harris told “Morning with Maria” last week: “What I want to do is I want to find cuts elsewhere in the budget, but if we can’t get enough spending cuts, we will have to pay for tax cuts.”

“Before the cuts and jobs bill, the highest tax rate was 39.6%, less than $1 million. Ideally, if we can’t find something we can do if we can’t find a reduction in spending, we say ‘Okay, OK, let’s get back to higher brackets, let’s set it to $2 million in revenue, the above is about the president’s president’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’’

But Johnson’s second place, House Majority Leader Steve Scalise, R-la. , poured cold water again in Tuesday’s thoughts.

Scalis told “Morning with Maria,” although he added: “I don’t support this initiative.

House Liberty Caucus Chairman Andy Harris says openness to the idea (Getty Image)

“That’s why you hear all kinds of thoughts bounce around. If we don’t take any action, you’ll see more than 90% of Americans seeing an increase in tax revenue,” Scalis warned.

Bloomberg News This is the first time to report House Republicans’ 40% tax hike proposal.

Click here to get the Fox News app

When commenting with it, the White House pointed Fox News digitization to a comment by press secretary Karoline Leavitt earlier Tuesday when she said Trump had no other proposal to increase corporate tax rates.

“I’ve come up with this idea. I’ve heard it. But I don’t believe the president has determined whether he supports it.”

Fox News Digital also contacted Johnson’s office for comment.